The Executive Chairman of the Federal Inland Revenue Service (FIRS), Zacch Adedeji, has applauded the Nigerian judiciary for its consistent and well-reasoned tax judgments, describing them as vital to ensuring stability, fairness, and confidence in the nation’s fiscal framework.

Adedeji made this known on Tuesday during a capacity-building workshop for Justices of the Supreme Court, Court of Appeal, and Judges of the Federal High Court on emerging tax laws. He also commended the National Judicial Institute (NJI) for organising what he described as a “timely and essential” training programme.

According to him, recent legislative changes—such as amendments to the Finance Acts, the Petroleum Industry Act, and other tax-related laws—have significantly transformed Nigeria’s fiscal environment. He stressed the need for closer collaboration between the judiciary and tax authorities to ensure fair interpretation and effective enforcement of these reforms.

“The judiciary, through its interpretative powers, remains the ultimate arbiter in maintaining the balance between the powers of tax authorities and the rights of taxpayers,” Adedeji said. “Your consistent and sound pronouncements have provided stability, predictability, and fairness in the administration of our tax system.”

He further noted that timely and consistent judicial rulings are essential for strengthening voluntary tax compliance, boosting investor confidence, and improving revenue generation. “Prompt and principled resolution of tax disputes promotes compliance and contributes to economic stability,” he added.

Reaffirming FIRS’s commitment to sustained collaboration with the judiciary, Adedeji pledged continued support through technical engagement, knowledge sharing, and regular dialogue. He also highlighted that the expanding global digital economy and increasing cross-border transactions introduce new tax complexities that require ongoing judicial education.

In conclusion, Adedeji expressed optimism that insights gained from the workshop would enhance the quality of judicial decisions and contribute to building a more efficient, equitable, and globally competitive tax system for Nigeria.

Business

News MasterUpdated 2 months Ago1 Mins read56 Views

News MasterUpdated 2 months Ago1 Mins read56 Views

Adedeji Lauds Judiciary’s Role in Strengthening Nigeria’s Tax System

Share

Latest Posts

Related Articles

Business

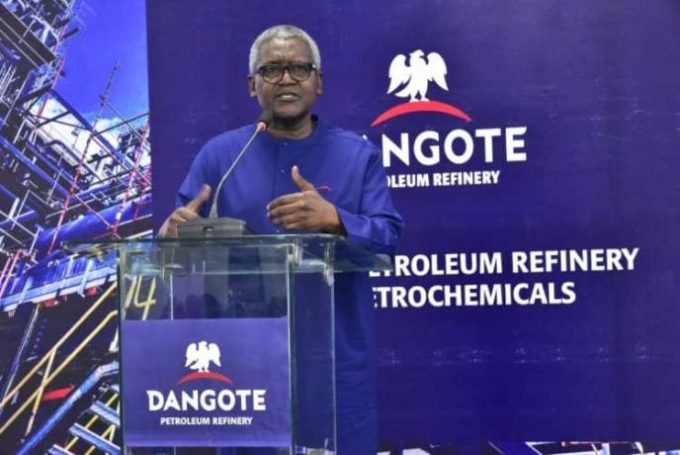

Dangote Gives Kaduna Businessman Seven Days to Retract Alleged False Allegations

Aliko Dangote, head of the Dangote Group, has given a Kaduna‑based businessman a...

23 hours Ago

Business

Gold Soars to New All-Time High on Weaker Dollar and Growing Fed Rate-Cut Expectations

Gold prices surged to an all‑time high on Monday, climbing to $4,383.76...

23 hours Ago

Business

PENGASSAN Urges Caution, Calls for Strong Institutions in Dangote–NMDPRA Dispute

The Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) has...

23 hours Ago

Business

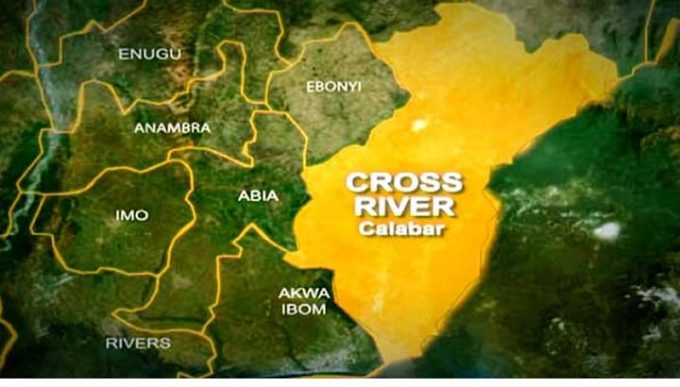

Cross River Police Arrest 10 Over Unlicensed Traditional Medical Practice

The Cross River State police have detained ten individuals for offering traditional...

23 hours Ago

Leave a comment