Nigeria’s pension fund assets grew by 22.03% in the third quarter of 2025, rising by over N4.71tn, as Pension Fund Administrators (PFAs) increased their investments in Federal Government securities, according to the latest monthly data from the National Pension Commission (PenCom).

The PenCom Monthly Industry Report showed that total pension assets climbed from N21.38tn in September 2024 to N26.09tn in September 2025, reflecting strong year-on-year growth in the Contributory Pension Scheme. The assets surpassed the N25tn mark in July 2025, closing at N25.79tn, and continued to rise in August to N25.89tn.

Federal Government of Nigeria (FGN) securities—including bonds, Sukuk, treasury bills, and agency securities—remained the dominant asset class, accounting for about 60% of total pension assets. PFAs increased their exposure to FGN instruments by roughly N3tn over the year, demonstrating confidence amid ongoing macroeconomic uncertainties.

Beyond government instruments, pension funds expanded their presence in the equities market, with Domestic Ordinary Shares rising by about N1.6tn year-on-year, supported by stronger market valuations, increased liquidity, and positive investor sentiment. Corporate debt instruments also saw higher allocations, reflecting improved credit conditions for top-rated issuers.

Retirement Savings Accounts (RSAs) recorded moderate growth, with membership reaching approximately 10.9 million. This growth was driven by increased compliance enforcement, onboarding of private-sector workers, and adoption of the rebranded Personal Pension Plan (PPP).

Speaking at the Annual Conference of the Pension Correspondents Association of Nigeria, PenCom Director-General Omolola Oloworaran highlighted the importance of deepening pension participation, particularly in the informal sector, which comprises an estimated 70–80 million Nigerians largely excluded from formal retirement savings. She emphasised that micro-pension reforms and digitisation are central to bridging the pension gap, improving financial inclusion, and ensuring dignified retirement outcomes.

Oloworaran, represented by PenCom’s Head of Corporate Communications, Ibrahim Buwai, noted that contributors now benefit from real-time acknowledgement of contributions and easy access to statements, with mobile-friendly, technology-driven solutions simplifying onboarding. Contributions under the PPP are structured with conservative and growth options tailored to participants’ preferences, further supporting long-term domestic capital mobilisation.

Home

Business

Nigeria’s Pension Fund Assets Surge to N26.09tn, Driven by FGN Securities and Equities

Business Nigeria’s Pension Fund Assets Surge to N26.09tn, Driven by FGN Securities and Equities

Share

Latest Posts

Related Articles

Business

Nigeria Strengthens Influence in Africa’s Monetary Integration Plans

Nigeria’s central bank has announced plans to deepen its engagement with continental...

1 day Ago

Business

Gombe Residents Receive ₦223m Interest-Free Loans to Boost Agriculture

The ACReSAL project has distributed over ₦223 million in interest‑free loans to...

1 day Ago

Business

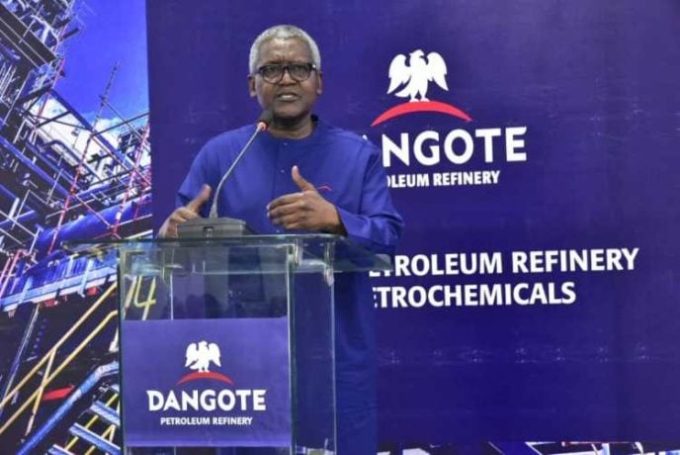

Dangote Group Boosts Industrial Growth with $400M Machinery Investment

The Dangote Group has announced a major investment to accelerate the development...

1 day Ago

Business

Lagos Waste Authority Cracks Down on Unregistered Cart Operators

The Lagos Waste Management Authority (LAWMA) has stepped up efforts to tackle...

1 day Ago

Leave a comment