Over 3.5 billion barrels of crude oil and condensate remain locked in undeveloped fields across Nigeria’s various basins, according to a publication by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC). At an average price of $65 per barrel, the reserves are valued at $227.5 billion—approximately ₦341.25 trillion at an exchange rate of ₦1,500 to the dollar. This staggering figure is over six times Nigeria’s proposed 2025 national budget of ₦54.9 trillion and could fund millions of infrastructural projects, such as over two million primary healthcare centres and over five million blocks of classrooms.

Despite the vast oil and gas potential, Nigeria’s budget deficit continues to widen, with over ₦13 trillion in the red. The 2025 fiscal plan allocates ₦13.64 trillion for recurrent spending, ₦23.96 trillion for capital projects, and ₦14.32 trillion for debt servicing. The country’s public debt has ballooned to ₦149.39 trillion as of Q1 2025, partly due to the naira’s depreciation and ongoing reliance on imports for refined petroleum, despite having dormant local refineries.

NUPRC’s report also reveals that 18.8 trillion cubic feet of associated and non-associated gas reserves remain untapped. Only 12.25% of deepwater oil and gas fields are developed, while a massive 31.65% are still lying idle, with 5.10% under consideration for future development. As of January 2025, 65% of discovered fields remain undeveloped, highlighting significant underutilisation of national energy assets.

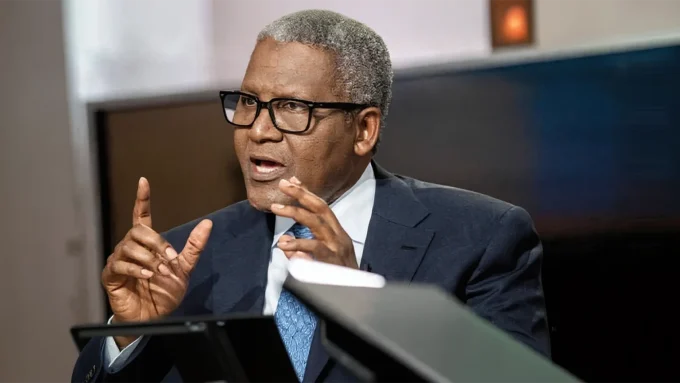

At the 50th anniversary of the Nigerian Association of Petroleum Explorationists, NNPC GCEO Bayo Ojulari (represented by EVP Upstream Udobong Ntia) stressed the urgent need to convert Nigeria’s oil reserves into production. Industry experts, including NAPE President Johnbosco Uche, urged the government to provide robust seismic data and consistent annual licensing rounds to attract investors. Meanwhile, the NUPRC confirmed that 220 oil blocks across the country remain unlicensed, mostly in deep offshore terrain, the Benue Trough, and the Chad Basin. The Petroleum Minister, Senator Heineken Lokpobiri, warned that the government may revoke idle licenses and reassign blocks to committed investors.

Business

News MasterUpdated 7 months Ago1 Mins read149 Views

News MasterUpdated 7 months Ago1 Mins read149 Views

Nigeria Sits on $227.5bn Untapped Oil Reserves Amid Soaring Debt and Budget Deficit

Share

Latest Posts

Related Articles

Business

Nigeria Airports Fully Adopt Digital Payment System with Four Options

The Federal Airports Authority of Nigeria (FAAN) rolled out an expanded cashless...

15 hours Ago

Business

FG Cracks Down on Mini Alcohol Packs to Curb Underage Drinking

The Federal Government has launched a new effort to ban the production,...

15 hours Ago

Business

Nigeria Sees Strong VAT Growth as Collections Reach N2.28 Trillion

Nigeria’s Value Added Tax (VAT) receipts rose significantly in the third quarter...

15 hours Ago

Business

Dangote Increases PMS Ex-Depot Price by N100 to N874 Amid Crude Oil Surge

Dangote Petroleum Refinery has raised its ex-depot price of Premium Motor Spirit...

16 hours Ago

Leave a comment