The Chief Executive Officer of Financial Derivatives Company Limited, Bismarck Rewane, has projected that Nigeria’s headline inflation will average 16 per cent in 2026.

Rewane made the projection during the presentation of the 2026 economic outlook organised by the Association of Corporate Treasurers of Nigeria (ACTN) over the weekend.

According to him, stability should not be seen as an end goal but as a tool for treasurers to preserve value, manage risk and support sustainable growth. He advised corporate treasurers to move away from defensive cash hoarding towards more strategic liquidity management, including better timing of foreign exchange (FX) conversions.

Rewane also emphasised the need for improved use of hedging instruments and stronger coordination between treasury functions and overall business planning.

Speaking on developments in the FX market, inflation trends and the global economic environment, he noted that the naira has experienced a significant loss in value over the past decade, falling from about ₦190 to the dollar in 2015 to approximately ₦1,430/$ in January 2026.

On the fundamentals driving the exchange rate, Rewane explained that exports have improved over the last five years, supported by modest gains in total factor productivity. He added that Nigeria’s trade balance currently stands at about six per cent of GDP, having improved in 2024 and 2025, with expectations of further gains in 2026.

However, he noted that rising debt repayments and servicing obligations continue to exert pressure on the FX market.

Rewane stated that, based on technical assessments, the naira is theoretically undervalued by 11.52 per cent in the official market. While this supports export competitiveness, he warned that it also raises import costs and inflationary risks.

Although the exchange rate appears relatively stable, he said it is not fully anchored, with projections indicating a possible movement from about ₦1,579/$ in 2026 to ₦1,811/$ by 2028.

Highlighting the implications of exchange rate stability for liquidity decisions, Rewane listed benefits such as improved cash flow predictability, better yields on surplus liquidity, enhanced funding structure alignment, optimised FX conversion timing and stronger liquidity risk management.

He concluded that inflation is expected to average around 16 per cent in 2026, largely due to the adoption of a new Consumer Price Index (CPI) methodology, which resulted in a sharp statistical drop caused by the base-year adjustment.

Business

News MasterUpdated 6 hours Ago1 Mins read6 Views

News MasterUpdated 6 hours Ago1 Mins read6 Views

Rewane Projects Inflation to Average 16% in 2026

Share

Latest Posts

Related Articles

Business

SERAP drags Adelabu, NBET to court over alleged N128bn power funds scandal

The Socio-Economic Rights and Accountability Project (SERAP) has instituted a lawsuit against...

6 hours Ago

Business

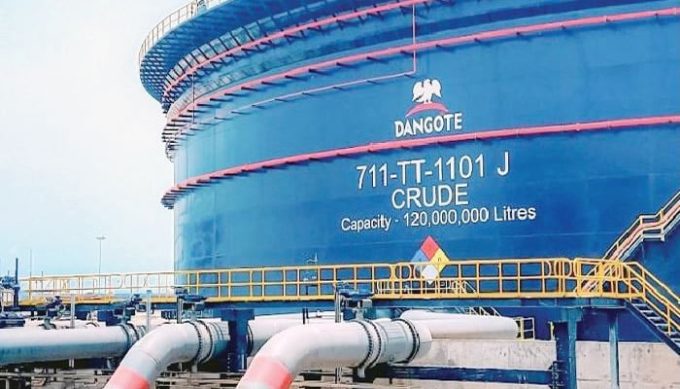

Dangote Refinery Adjusts Operations Amid Key Unit Downtime

The Dangote Petroleum Refinery has begun processing lighter grades of crude oil...

6 hours Ago

Business

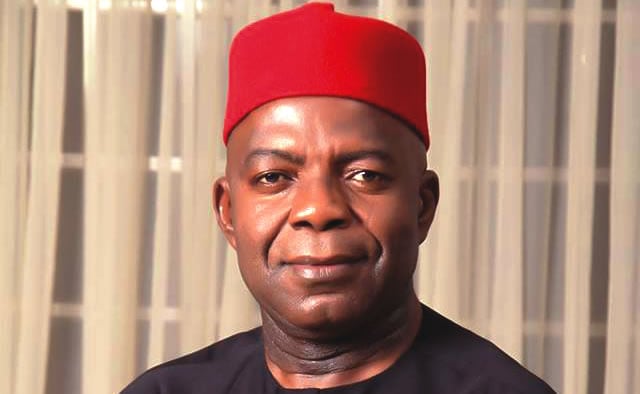

Abia State Partners with Insurance Brokers to Drive Public Awareness

Abia State Governor Dr. Alex Otti has announced a partnership with the...

6 hours Ago

Business

NNPC, Chevron Announce Major Offshore Oil Discovery

The Nigerian National Petroleum Company Limited (NNPC Ltd) has confirmed that the...

6 hours Ago

Leave a comment